What is Credit Card and How Credit Card Industry works.

Online Credit Cards 101 - What is credit card?

The Credit card is the term used for plastic cards issues by credit lenders(Banks, Financial companies, Retailers etc.) to card users (Customers). In essence a credit card is way to pay for your purchases to the merchants without actually paying them in cash or checks.

It is a payment process in which your credit card issuer pays the payment to the merchant wherever you do the purchasing. This is done against the promise to pay same shopping amount plus any interest applied on purchasing amount to Credit Card Company.

Basically you get the grace period of credit card billing normally 30 days to pay the owed amount back to the Credit Card issuer. This is great way to save yourself from carrying a large amount of money for a big ticketed items.

According to Wikipedia - "A credit card is a payment card issued to users as a system of payment. It allows the cardholder to pay for goods and services based on the holder's promise to pay for them. The issuer of the card creates a revolving account and grants a line of credit to the consumer (or the user) from which the user can borrow money for payment to a merchant or as a cash advance to the user.

There are other type of credit cards such as prepaid or charge cards but they are not the same as Credit Cards. I am citing reference from Wikipedia about difference between a charge card and a credit card - "A credit card is different from a charge card: a charge card requires the balance to be paid in full each month. In contrast, credit cards allow the consumers a continuing balance of debt, subject to interest being charged.

A credit card also differs from a cash card, which can be used like currency by the owner of the card. A credit card differs from a charge card also in that a credit card typically involves a third-party entity that pays the seller and is reimbursed by the buyer, whereas a charge card simply defers payment by the buyer until a later date."

Source: Wikipedia - Read more on ABC of Credit Cards

Step 1:

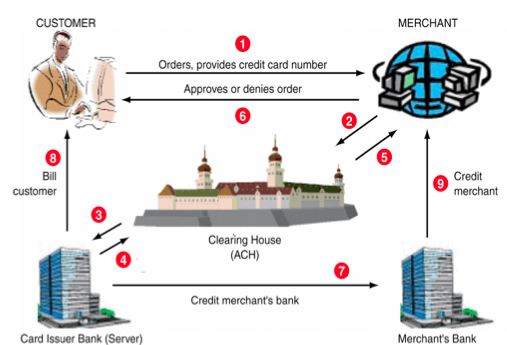

Customer: The first step to Credit Card transaction is customer buying product at Merchant store. Customer walks into a Merchants store for purchasing goods. Customer buys goods and presents Credit card for making payment.

Step 2:

Point of Sale: Next step is customer paying for purchased goods. Customer swipes Credit Card through point of sale equipment. After Credit Card is swiped through Point of sales software the authorization request is sent to payment authorization network (VISA/Mastercard/AMEX/DISCOVER).

Point of Sale: Next step is customer paying for purchased goods. Customer swipes Credit Card through point of sale equipment. After Credit Card is swiped through Point of sales software the authorization request is sent to payment authorization network (VISA/Mastercard/AMEX/DISCOVER).

Step 3:

Clearing house: - Authorization Center: Facilitates payment authorization process with request to Card issuing bank for balance check and request for approval.

Clearing house: - Authorization Center: Facilitates payment authorization process with request to Card issuing bank for balance check and request for approval.

Card Issuing Bank: The bank systems receive request for purchase approval and a request for approval code from payment authorization system. Internal bank process will check customers credit card account, if credit funds are available, bank will approve or deny the purchase and send approval code to payment authorization system/ Merchant.

Card Issuing Bank: The bank systems receive request for purchase approval and a request for approval code from payment authorization system. Internal bank process will check customers credit card account, if credit funds are available, bank will approve or deny the purchase and send approval code to payment authorization system/ Merchant.

Step 5:  Payment processing: The Credit card issuing bank issues payment to payment processing company with approval code. The merchant will send transactions of day to payment authorization/processing center for payments.

Payment processing: The Credit card issuing bank issues payment to payment processing company with approval code. The merchant will send transactions of day to payment authorization/processing center for payments.

Step 6:

Money deposit: After payment processor receives the money from Credit card issuing bank and the batch transactions from Merchant. The money against batch transactions is deposit to Merchants bank.

Money deposit: After payment processor receives the money from Credit card issuing bank and the batch transactions from Merchant. The money against batch transactions is deposit to Merchants bank.

Step 7:

Credit Card Bill: Credit card companies send credit card bills once a month to customers giving details of purchases made in last billing cycle and the important information such as Minimum due amount, Total amount, Credit available and the credit used so far.

Credit Card Bill: Credit card companies send credit card bills once a month to customers giving details of purchases made in last billing cycle and the important information such as Minimum due amount, Total amount, Credit available and the credit used so far.

Customer can always dispute any transaction if that doesn't look ok and can contact Credit card company by phone, mail or via internet contact us system.

Here is one video on YouTube giving pictorial/video description of Credit Card payment information.

Source: What is involved in Credit Card Transaction - YouTube

What is PCI - Payment Card Industry Data Security Standards (PCIDSS)

The PCI is set of payment security standards used in implementing for handling credit card transactions and in managing Credit card account and Credit card transactions.

All the major credit card companies (VISA, MasterCard, AMEX, DISCOVER etc.) had their own version of PCI standards but more or less very much common with each other. In 2003 all of them joined together to create one universal PCI standard under version 1.0 for merchants, banks, and finance companies to implement how they store, process and remit credit card payments. Since 2003 there has been many revision to PCI standards and the current PCI standard is 3.0 released in 2013.

PCI security standards cover a set of control measures, and each control measures breaks into a set of requirement.

Source: Wikipedia - Payment Card Industry Data Security Standard

More on Online Credit Cards - << Read more >>

It is a payment process in which your credit card issuer pays the payment to the merchant wherever you do the purchasing. This is done against the promise to pay same shopping amount plus any interest applied on purchasing amount to Credit Card Company.

Basically you get the grace period of credit card billing normally 30 days to pay the owed amount back to the Credit Card issuer. This is great way to save yourself from carrying a large amount of money for a big ticketed items.

According to Wikipedia - "A credit card is a payment card issued to users as a system of payment. It allows the cardholder to pay for goods and services based on the holder's promise to pay for them. The issuer of the card creates a revolving account and grants a line of credit to the consumer (or the user) from which the user can borrow money for payment to a merchant or as a cash advance to the user.

There are other type of credit cards such as prepaid or charge cards but they are not the same as Credit Cards. I am citing reference from Wikipedia about difference between a charge card and a credit card - "A credit card is different from a charge card: a charge card requires the balance to be paid in full each month. In contrast, credit cards allow the consumers a continuing balance of debt, subject to interest being charged.

A credit card also differs from a cash card, which can be used like currency by the owner of the card. A credit card differs from a charge card also in that a credit card typically involves a third-party entity that pays the seller and is reimbursed by the buyer, whereas a charge card simply defers payment by the buyer until a later date."

Source: Wikipedia - Read more on ABC of Credit Cards

How Credit Card System Works

Source:Photo bucket

Credit Card Players involved: Customer, Merchant, ACH Clearing house or Authorization center, Card issuing Bank, Card Acquiring bank

Let's understand Credit card Transaction Cycle:Step 1:

Customer: The first step to Credit Card transaction is customer buying product at Merchant store. Customer walks into a Merchants store for purchasing goods. Customer buys goods and presents Credit card for making payment.

Step 2:

Step 3:

Step 4:

Step 6:

Step 7:

Customer can always dispute any transaction if that doesn't look ok and can contact Credit card company by phone, mail or via internet contact us system.

Here is one video on YouTube giving pictorial/video description of Credit Card payment information.

Source: What is involved in Credit Card Transaction - YouTube

What is PCI - Payment Card Industry Data Security Standards (PCIDSS)

The PCI is set of payment security standards used in implementing for handling credit card transactions and in managing Credit card account and Credit card transactions.

All the major credit card companies (VISA, MasterCard, AMEX, DISCOVER etc.) had their own version of PCI standards but more or less very much common with each other. In 2003 all of them joined together to create one universal PCI standard under version 1.0 for merchants, banks, and finance companies to implement how they store, process and remit credit card payments. Since 2003 there has been many revision to PCI standards and the current PCI standard is 3.0 released in 2013.

PCI security standards cover a set of control measures, and each control measures breaks into a set of requirement.

| Control Objectives | PCI DSS Requirements |

|---|---|

| Build and Maintain a Secure Network | 1. Install and maintain a firewall configuration to protect cardholder data |

| 2. Do not use vendor-supplied defaults for system passwords and other security parameters | |

| Protect Cardholder Data | 3. Protect stored cardholder data |

| 4. Encrypt transmission of cardholder data across open, public networks | |

| Maintain a Vulnerability Management Program | 5. Use and regularly update anti-virus software on all systems commonly affected by malware |

| 6. Develop and maintain secure systems and applications | |

| Implement Strong Access Control Measures | 7. Restrict access to cardholder data by business need-to-know |

| 8. Assign a unique ID to each person with computer access | |

| 9. Restrict physical access to cardholder data | |

| Regularly Monitor and Test Networks | 10. Track and monitor all access to network resources and cardholder data |

| 11. Regularly test security systems and processes | |

| Maintain an Information Security Policy | 12. Maintain a policy that addresses information security |

Source: Wikipedia - Payment Card Industry Data Security Standard

More on Online Credit Cards - << Read more >>

No comments:

Post a Comment